Hello Readers,

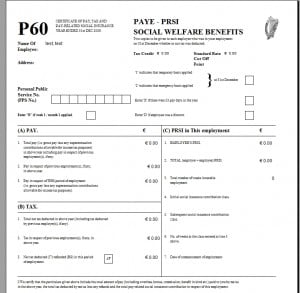

If you are currently in employment, your employer has probably sent you your P60 in the last few weeks.If you have never seen a P60 , it looks like this.

If you haven’t received yours yet, I’d suggest you contact your employer, maybe it’s gone missing…

What is the P60?

Your 2011 P60 form shows how tax was calculated for the year just

gone. And the amount of tax calculated is based on your life and how we

live it.

But importantly: Only what we have told Revenue about our circumstances.

Most of us will receive our P60s in February and many of us will quickly put them in “the drawer”, not really knowing what purpose they serve.

However, it is more useful than you might think. The information on that

form now in “the drawer” can be used to claim your tax back from 2011.

That’s right – take it out and keep on reading…You might be pleasantly surprised!

All workers in Ireland can apply for a tax refund.

It is not obligatory so not everyone does it but hundreds of thousands

of euro go unclaimed every year in tax reliefs and overpaid taxes.

You can find the full list here : Claim for your refund 2011 – Guidelines

Following are links to the most populars items you can claim for.

Each link explains what charge(s) qualify, and how you can claim for them.

Paid Bin charges ( up untill 2011, as from 2012 you can no longer claim for it)

Check out http://www.revenue.ie/en/tax/it/leaflets/it27.html

Paid Tuition Fees : Check out http://www.revenue.ie/en/tax/it/reliefs/tuition-fees.html

Paid Doctors/dentists bills : http://www.revenue.ie/en/tax/it/leaflets/it6.html

Rented propery in the last 4 years: check out http://www.revenue.ie/en/tax/it/credits/rent-credit.html

Member of a trade union – you can no longer claim for this, however as you can claim up to 4 years, if you didn’t claim for 2010, 2009,2008, you still could:)

Did you get married in 2011?

Check out http://www.revenue.ie/en/personal/circumstances/marriage.html#section2

And last but not least, did you have a baby in 2011 – check out my previous

article here , you might be due a nice little refund( please note, you can only go back 4 years, so do get your skates on before it’s too late…:)Do take your time for this one, it will be time worth spent 🙂

I also found this list of “flate rate expenses ” http://www.revenue.ie/en/tax/it/leaflets/flat-rate-expenses.xls relevant to a variety of occupations, do check it out, you may find out there is a flat rate expense you can claim for.

Good luck sorting out those bills and hopefully you’ll get a nice refund..

Thanks,

Katleen

|

|